🔥 Popular Free Downloads

THE FULL WORKS

All of our staff training manuals in one handy download!

FREE STAFF HANDBOOK

A totally customisable free staff handbook download.

FREE PROFIT & LOSS CALCULATOR

Keep on top of your expenses with our free profit and loss calculator.

⭐ Popular Resources

SWOT ANALYSIS

SWOT Analysis explained in detail accompanied by a free download.

DOWNLOADS HUB

The place to download all of our free forms, templates & guides.

FREE CASH FLOW CALCULATOR

Download our free template or use our online cash flow calculator.

FREE MARKUP CALCULATOR

Maximise your profits with our free markup calculator tool.

BAR MANAGEMENT TRAINING

Simple and free online bar and cellar management training.

🔥 Popular Pages

- How to Run a Restaurant

- Awesome Articles

- Managing Your Staff

- Marketing Your Restaurant

- Restaurant Financing and Funding

- Maintaining Neutrality in Pronoun Usage

- Everything You Wanted To Know About Gin

- Safe Cooking Temperatures For Meat

Understanding Restaurant Profit and Loss (P&L)

Written by The Restaurant Doctor UK Team

Last Updated: 1st November 2023

A Profit and Loss (P&L) statement is a financial document that provides a summary of a restaurant's revenue, expenses, and profit over a specific period of time. It is also commonly referred to as a Profit and Loss Account, Income Statement or Statement of Operations. The P&L statement is one of the most important financial statements for any restaurant, as it provides valuable insights into the financial health of the company.

What's on this page:

What is a Profit and Loss Statement?

Restaurant Profit & Loss Calculator

Structure of the Profit and Loss Statement

Example Profit and Loss Statement

How to Read a Restaurant P&L

Using Your Profit and Loss Account

Restaurant Profit and Loss Template Download

What is a Profit and Loss Statement?

A Profit and Loss statement is a report that shows the revenue and expenses incurred by a business over a specified period. The P&L statement is used to calculate the net income or profit of a business. The final profit figure is arrived at by subtracting all expenses from the total revenue generated. The P&L statement is a critical tool for business owners, as it helps them to understand the financial performance of their business and make informed decisions about their finances.

Restaurant Profit & Loss Calculator

How to use our Profit & Loss Calculator

Total Revenue

Enter the total revenue generated by your restaurant. This should be the total amount of money earned from sales before any expenses are deducted.

Cost Of Goods Sold (COGS)

Enter the total cost of goods sold. This includes the direct costs attributable to the production of the goods sold by your restaurant, such as raw materials.

Expenses

Enter the total expenses incurred by your restaurant. This should include all operating expenses such as rent, utilities, salaries, marketing expenses, etc.

Results

The calculator will display four results:

Gross Profit. The total revenue minus the cost of goods sold.

Gross Profit Margin. The percentage of total revenue that exceeds the cost of goods sold.

Net Profit. The gross profit minus the total expenses.

Net Profit Margin. The percentage of total revenue that remains after all expenses have been deducted.

Structure of the Profit and Loss Statement

The structure of a P&L statement typically includes the following sections:

1. Revenue: This section shows the total amount of money earned by the business over the specified period.

2. Cost of Goods Sold (COGS): This section shows the direct costs associated with producing and selling the goods or services offered by the business.

3. Gross Profit: This section shows the difference between revenue and COGS, and represents the profit made from the sale of goods or services before accounting for other expenses.

4. Operating Expenses: This section includes all the indirect expenses incurred by the business, such as rent, utilities, salaries, and marketing expenses.

5. Net Income: This section shows the final profit or loss of the business after accounting for all revenue and expenses.

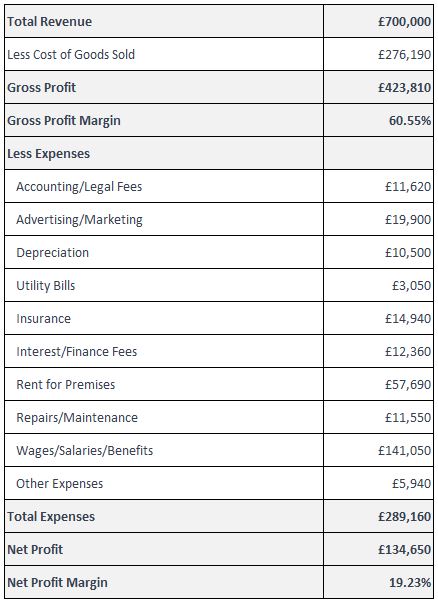

Example Profit and Loss Statement

Here is an example of a simple P&L statement:

In this example, the business earned £700,000 in revenue and incurred £276,190 in COGS. The gross profit is £423,810, which is the difference between the revenue and COGS. After accounting for operating expenses of £289,160, the business has a net income of £134,650.

How to Read a Restaurant P&L

To effectively analyse a restaurant P&L statement, you should focus on the following key metrics:

Gross Profit Margin:

This metric shows the percentage of revenue that remains after accounting for COGS. A high gross profit margin indicates that the business is earning a good profit from its sales.

Operating Expense Ratio:

This metric shows the percentage of revenue that is spent on operating expenses. A high operating expense ratio can indicate that the business is spending too much on indirect expenses.

Net Income:

This metric shows the final profit or loss of the business after accounting for all revenue and expenses. A positive net income indicates that the business is profitable, while a negative net income indicates that the business is operating at a loss.

Using Your Profit and Loss Statement

The P&L account can be used for a variety of purposes, including:

Assessing the financial health of the business:

The P&L statement provides valuable insights into the financial performance of the business, making it easier for business owners to assess the financial health of their company.

Making informed decisions about finances:

The P&L statement can help business owners make informed decisions about their finances, such as whether to invest in new equipment or hire additional employees.

Determining pricing strategies:

The P&L statement can be used to determine the cost of goods sold, which can then be used to set prices for products or services in a way that ensures a reasonable profit margin.

Measuring performance over time:

By comparing P&L statements from different periods, business owners can measure the performance of their business over time and identify trends in their revenue and expenses.

The Balance Sheet

It's important to note that the P&L account should be used in conjunction with other financial statements, such as the balance sheet, to get a complete picture of the financial health of a business. The balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time, while the P&L statement provides information about the company's financial performance over a specific period of time.

Cash Flow

Additionally, the P&L statement should be considered alongside the cash flow statement, which provides information about the inflows and outflows of cash in a business. Understanding the relationship between the P&L statement, the balance sheet, and the cash flow statement is critical for making informed decisions about the finances of a business.

A Profit and Loss statement is a critical tool for any business, providing valuable insights into the financial performance of the company. By understanding the structure of the restaurant P&L statement, how to analyse it, and how to use it in conjunction with other financial statements, business owners can make informed decisions about their finances and improve the financial health of their business.

Restaurant Profit and Loss Template Download

Start taking control of your restaurant finances today with our free restaurant p&l template. With its user-friendly format, you can easily track and analyse your revenue, expenses, and profits. Download it now to gain valuable insights into your financial performance and make informed decisions for your restaurant.

To download your free profit and loss template, click on the download link below:

👉 YOUR DOWNLOAD

You may also like...

Business Finance, Credit, Borrowing Money and Funding:

Looking to borrow money or wanting to apply for a credit card, mortgage, overdraft, business loan or even car insurance for your restaurant? This article covers the areas you need to consider when applying for finance, borrowing money and applying for credit for your business. Looking after your money is important, especially money you borrow.